If you think your Wood County, Ohio property is assessed too high, you can file a Property Tax Valuation Appeal to request a lower value. Homeowners submit proof such as recent appraisals, comparable sales, or photos to show why the assessment is incorrect. Appeals are filed with the Wood County Board of Revision between January 1 and March 31. After reviewing your documents, the board may hold a hearing and decide whether to adjust your property value. This simple process helps ensure you only pay the fair amount of property taxes.

Why You Might Need to Appeal Your Property Valuation

You may need to appeal if your home’s assessed value is higher than its true market price, if similar homes are valued lower, or if the county overlooked damage or condition issues. Appealing helps make sure you’re not overpaying in property taxes.

Common Reasons to Appeal:

- Your home is assessed higher than similar properties.

- The county didn’t consider damage or needed repairs.

- Recent sales in your area show lower market values.

- The assessment is based on outdated or incorrect data.

- Your property details (size, condition, features) are recorded inaccurately.

Step-by-Step Guide: How to Appeal Property Tax Valuation in Wood County

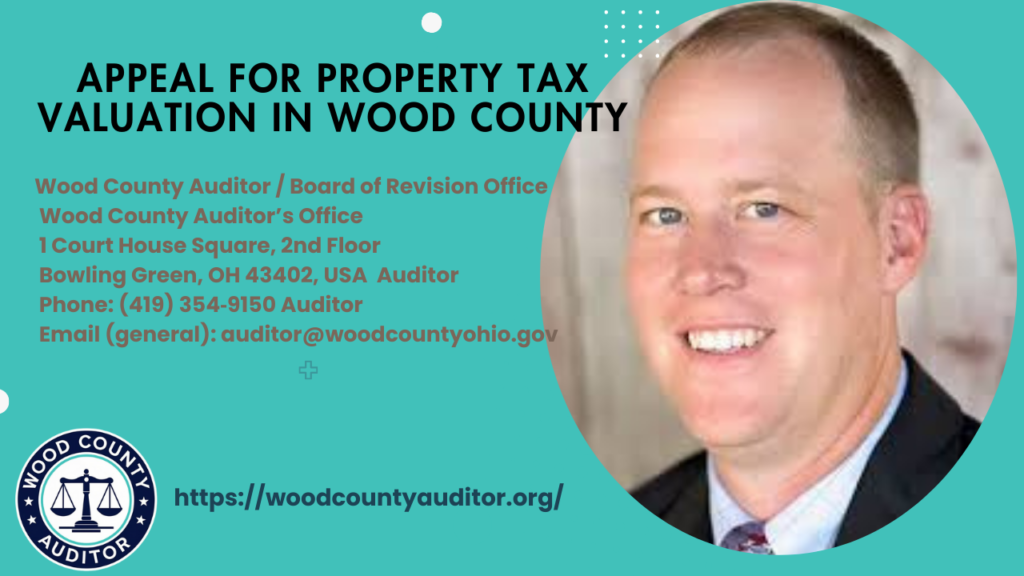

To appeal your property value, review your assessment, gather proof like appraisals or photos, and fill out the DTE Form 1. Submit it to the Wood County Auditor’s Office between January 1 and March 31. If a hearing is held, present your evidence. The Board of Revision will then review your case and send a decision.

Step 1: Review Your Property’s Current Valuation Notice

Check your valuation notice and compare it with recent sales of similar homes. Look for errors in your property’s size, condition, or details to decide if an appeal is needed.

- Appraised Value: The market value determined by a professional appraisal.

- Assessed Value: The value assigned by the county for tax purposes.

- Property Details: Size, condition, features, and any recent improvements.

- Contact Information: County Auditor’s office or Board of Revision contact for questions.

Check for errors or mismatched information. Even a small mistake can affect your taxes.

Step 2: Gather Proof to Support Your Claim

Collect evidence like appraisals, repair photos, improvement estimates, and recent sales of similar homes to show your property is overvalued.

Useful documents include

- Recent property appraisals

- Photos of damage or needed repairs

- Repair or improvement estimates

- Sales data of similar homes

- Property tax records

Tip: The stronger the evidence, the higher the chance of approval.

Step 3: File a Formal Appeal With the Board of Revision (BOR)

Complete the official DTE Form 1 to start your appeal and submit it to the Wood County Board of Revision.

You must submit:

- DTE Form 1 (Complaint Against the Valuation of Real Property)

Supporting documents

Important deadlines

Make sure to include all supporting documents and meet the filing deadline, usually between January 1 and March 31. Proper filing ensures your appeal is reviewed on time.

Step 4: Submit Your Appeal Online, By Mail, or In Person

You can file your appeal using any of these methods:

Submit your completed appeal form and documents:

- Online via the Wood County Auditor’s portal

- By Mail to the Auditor’s office

- In Person at the Auditor’s office

Keep copies of all documents for your records.

Confirm your submission meets the filing deadline.

Step 5: Attend the Board of Revision Hearing

After your appeal is reviewed, the Board will schedule a hearing where you can:

- Attend the hearing if scheduled by the Board of Revision.

- Bring all supporting documents and evidence.

- Clearly explain why your property’s assessed value should be lowered.

- Answer any questions from the board regarding your app

Hearings are usually 15–20 minutes long.

Tip: Be clear, confident, and stick to facts.

Step 6: Wait for the Board’s Final Decision

After the hearing:

- The Board of Revision reviews all submitted evidence.

- Receive a written notice with the decision.

- Any adjustments to your property’s assessed value will be included.

- The board’s decision is final unless you choose to appeal in court.

If the Board agrees, your property value and your taxes will be reduced.

If you disagree with the decision, you can appeal further to:

- Ohio Board of Tax Appeals (BTA): State-level review of your case.

- Court of Common Pleas: Local court for property tax disputes.

- Ohio Supreme Court: Only if your case involves significant legal questions.

How to Improve Your Chances of a Successful Appeal

- Gather strong evidence: appraisals, repair estimates, comparable sales.

- Ensure property details are accurate.

- Submit your appeal on time.

- Clearly explain why your assessed value is too high.

- Be organized and professional at the hearing.

Conclusion

Filing a property tax appeal in Wood County gives homeowners a chance to ensure their property is fairly assessed. By reviewing your valuation, gathering strong evidence, submitting your appeal on time, and presenting your case effectively, you can potentially lower your taxes and protect your finances. Taking these steps helps make sure you pay only what is fair for your property.

Q1: Who can file a property tax appeal?

A: Any Wood County property owner who believes their property is overvalued.

Q2: When is the appeal filing period?

A: Typically from January 1 to March 31 each year.

Q3: What evidence is needed for an appeal?

A: Recent appraisals, photos of damage, repair estimates, and sales of similar homes.

Q4: How do I file an appeal?

A: Complete DTE Form 1 and submit it online, by mail, or in person to the Board of Revision.

Q5: Can I appeal further if the board denies my claim?

A: Yes, you can appeal to the Ohio Board of Tax Appeals or the Court of Common Pleas.

Q6: Will attending the hearing help my case?

A: Yes, presenting your evidence and clearly explaining your claim increases your chances of success.